The Lean Portfolio

In previous posts I discussed why serial entrepreneurs should upgrade to parallelism, and how startup founders might band together to create a startup cooperative. It is this thinking that is shaping our new company, Scale Front. In addition to adopting Lean, we want to develop many ideas in parallel. We are calling this approach “The Lean Portfolio”. Much as The Lean Startup articulates what the best startups are doing, “The Lean Portfolio” is a name for the next logical step.

The Changing Face of Startups

In the last 10 years the cost of starting up dropped massively, with everything from email servers to accountancy moving to the cloud. Digital sales channels such as app stores and social media have made it possible to go global on a shoestring. Capital efficient strategies such as the Lean Startup and Agile Development have helped us focus fewer resources into more impactful products. It is not uncommon now to see founders bootstrap a company to profitability, raising funding after they are breaking even.

Many investors are finding themselves challenged in this shifting landscape: much of the action is at the microfunding level, which they cannot efficiently deal with. The cost of managing these deals could threaten to exceed the amounts invested. Investor-backed accelerators are one response to this problem, but many remain unconvinced.

I believe that the next effect of shinking costs is that entrepreneurs will take a leaf from the venture capital book and begin to form their own portfolios. In fact, this is already happening. In Berlin, the Samwer bros are doing it with tremendous success, with their Rocket Internet portfolio teeming with over 20 startups, and exits including CityDeal, Jamba and Alando. Rocket has recently spawned another portfolio, Project A Ventures. There’s actually quite a cluster in Berlin, with startup portfolios also being run by Team Europe Ventures (15 startups/10 exits), Rebate Networks (startups in 20 markets), and Springstar (recently teamed up with Airbnb to take it global). In Brazil, IG Expansion, Internet24 and Xango are taking a similar approach, focusing on Latin American markets. In New York, Betaworks focuses on building startups for the social web. In Santa Monica, Science Inc aims to combine “ideas, talent, resources and financing” in the startups it builds. In San Francisco, Sandbox Industries is combining its $18M fund with a “foundry”, where recruited entrepreneurs share resources while developing concepts into companies.

EDIT 20 May 2012: Since writing this, two others have come to my attention: Milk and Churn Labs

While many of these are klonfabriken, copying business models from Silicon Valley, others are focusing on novel ideas. Many are funded, all are spinning out startups, and most are already making significant money from exits.

At Scale Front, we are aiming to bootstrap 10 new projects to market in 2012, using the Lean Startup model. We intend to scale this number over time, and to retain every lesson possible so that projects get better over time. We’re calling this approach “The Lean Portfolio”, and see it as the next logical step to the Lean Startup.

The “EPIC” Molecule

A bit of quick research on the companies above reveals striking similarities in their language and thought processes. Having written down our own plan before googling these guys, I was initially shocked to see my words on their websites. My second reaction was extreme validation that such talented people had reached the same conclusions.

A bit of quick research on the companies above reveals striking similarities in their language and thought processes. Having written down our own plan before googling these guys, I was initially shocked to see my words on their websites. My second reaction was extreme validation that such talented people had reached the same conclusions.

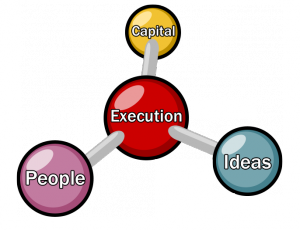

The common thread running through these companies is what I’m going to cheesily refer to as the EPIC molecule. The four elements that combine to make this super-strong molecule are: Execution, People, Ideas and Capital. Rocket Internet’s CEO calls them their “four pillars: the idea; the money; the people and the execution”. Science Inc talks about “ideas, talent, resources and financing”. Team Europe lists “idea, team, product/IT, reach and finance”. IG Expansion talks about business model, team, operations and finance.

All are basically referring to the same four elements. By bringing these together the Lean Portfolio optimizes both the rate at which it generates startups, and the quality of those startups. Let’s take each of these one by one.

Element #1: Execution

I subscribe to Steve Blank’s definition that a startup is a search for a profitable repeatable business model. Entrepreneurs usually spend a few years conducting this search before spending a few more building a company. By the time the entrepreneur moves on to a second startup the lessons learned from the first search are fading and often outdated.

In Scale Front we want to keep a core staff in place, retaining lessons from every search. We want to build this intellectual capital up over time, rather than lose it to spin outs where it won’t even be that relevant. Our number one objective is to build our organisational ability to execute the search for great business models. We are starting with a process based on the Lean Startup, and intend to refine our own version of it over time. With improvements to the process, and ever-greater experience executing it, we expect to be able to launch a greater number of spin outs with every passing year.

Apart from building up and concentrating intellectual capital around the startup process, the portfolio approach will allow us to establish shared resources that couldn’t be justified for any one project alone. These range from software systems (e.g., analytics and billing), to human resources (e.g., accountants, lawyers, development and design). In fact, even the entrepreneurs themselves are essentially a shared resource, moving between projects rather than doing excess work on unvalidated product features.

Element #2: People

The portfolio is built upon the talent and skills of the entrepreneurs recruited to develop pre-traction projects and later to lead them out into the world. To attract the best, we want to provide benefits that are inaccessible to solo entrepreneurs. Our hope is that Scale Front will be a family of entrepreneurs, benefiting from each other’s support and success, while being rewarded for individual contributions.

Staff entrepreneurs should be:

- paid a proper salary while working on pre-traction projects

- given the opportunity to lead a spin out as soon as possible

- given a very substantial stake in any business he/she leads

- given stock options on the portfolio as a whole

We want to attract the best talent by being able to honestly tell them that the opportunities within the portfolio are greater than those without: they will lead a successful business, and their stake in it will be more valuable than the average startup.

Element #3: Ideas

Unlike accelerators, which recruit teams that already have ideas, the Lean Portfolio recruits entrepreneurs and creates its own ideas. Some people mistake the idea for the valuable bit of a startup. In contrast, we know that ideas are plentiful. When you’re in flow, they come to you constantly. If you burn through enough bad ones you’ll discover one that’s great, and the portfolio is designed to do this as fast as possible.

In Scale Front we have an “idea bank” (a phrase borrowed from the Stage Gate process). To make it into the bank, each idea must be capital efficient and have the potential to get to MVP in less than 30 man days. We currently have over 30 ideas in the bank, and we’re pretty sure we’re going to continue to have more ideas than we can possibly test, because testing each one always seems to generate several more.

What is really exciting is the realization that the ideas will inevitably improve with time. Experienced founders know that when you have traction you continuously spot adjacent customer needs, which you rarely have the time to do anything about. Lean Portfolio entrepreneurs can send these ideas back for investigation. These ideas come with a prevalidated customer need, and with access to early customers through the spinout that originally spotted the opportunity.

Element #4: Capital

Bootstrapped startups often find that when they most need growth capital, they have no time to raise it without neglecting their customers. The final element of the Lean Portfolio is to facilitate funding when spin outs need some cash. This funding may come from external sources, or from the portfolio itself if it has a sufficient warchest. Access to capital will improve over time as the portfolio builds relationships with investors. Meanwhile the close relationship between portfolio and spinout will permit much of the footwork to be performed on behalf of the entrepreneur, leaving him/her to focus on business.

Our Story So Far

For us, the portfolio approach is the only logical way forward. It allows us to scale our own experience more effectively, making the biggest impact possible with our limited time.

We are bootstrapping by balancing consultancy work with internal projects. Bootstrapping is slow, but the pace allows us to extract every possible lesson from our first few projects, establishing our own execution process as we go. We will soon launch our second product, and will temporarily double headcount with interns tasked with market testing. Looking towards the future, we may choose to raise external funding to increase the number of projects we can run. In subsequent posts I’ll discuss some of the lessons we’re learning, and reflect on the challenges and advantages that we’re discovering in the portfolio approach.

Archived Comments

May 5, 2012 at 7:08 pm, Killian Murphy says:

Great post Sean.

As you say, there are a number of people executing somewhat similar approaches, you mention several I was unaware of. The first one I came across was Obvious Corp, started by Ev Williams of Blogger. I was very taken with the idea at the time. Of course, one of their first products was Twitter, which quickly eclipsed Obvious.

In the world outside of Tech, investment banks are run along moderately similar lines. An investment bank is really a pile of capital and a bunch of small businesses using it in various ways, with centralized services (finance, legal, IT, HR, ..). There are obvious differences, but there are significant parallels also. The banks are open to funding new ideas and compensating people appropriately based on their success (primarily) and on the overall organization’s success (secondarily). Interestingly, they fund people with conflicting goals and let the market sort it out. The startups use the prestige and capital of the parent to attract business, so they have an advantage over standalone organizations doing the same thing. The downside of their model, obvious to everyone now, is that the parent company is susceptible to catastrophic failure of one of the “startups” (even though these are typically separate legal entities) primarily due to the need to retain trust in the parent. This also impacts all of the other businesses. e.g. Lehman’s structured products startups failed catastrophically, taking out their M&A, corporate finance and other (perfectly good) businesses along with it. Lessons from this: You need to be able to allow one of the spinouts to fail, or you need to be able to bail it out, while isolating the wider business in either case. (interestingly, one of the first things that Obvious did was “bail out” Odeo, by buying back the stock from their investors).

Interestingly I have found big tech companies to be quite different. They tend to focus on the successful products, extracting as much value as possible but making it difficult to shift as the market shifts. The internal politics are typically aligned to avoid competition with the successful product, so ultimately it gets cannibalized externally rather than internally. One tech company that leveraged internal competition quite successfully was Microsoft, though the competition typically happened well in advance of a public product. Some lessons from this: You may want to be able to make multiple bets in a space, and you want to be able to create a competitor to / the next generation of your successes. The latter is, of course, a problem you hope to have, as it presupposes a success.

Y combinator is clearly following at least some of this model. They are more loosely coupled, and in particular I don’t believe they give each entrepreneur a position in the overall fund. I’m a big fan of your model in this respect. It’s more likely to lead to positive cooperation between your spinouts.

Lastly, the valley VC guys are nibbling on the edges of some of this, with incubator spaces, networking between their investments and use of the VC’s contacts etc to do portfolio presentations to large customers / partners / etc. But as you say, they haven’t figured out how to scale to the level you outline yet. Their advantage is also their disadvantage – they have too much money to invest.

Bottom line, I love the idea and I’m delighted to see someone pursuing it in Ireland. I’ve felt for some time that Ireland could use a Y combinator equivalent, given the level of entrepreneurial talent and the lack of risk capital (with the emphasis on risk). You’re setting yourselves up nicely to fill that need.

Good luck. Killian Murphy.

May 9, 2012 at 10:14 am, Sean Blanchfield says:

Thanks Killian. There’s not much info to be found online about Obvious Corp, apart from the “bail out” of Odeo, as you put it. However, as the organisation that launched Twitter, it makes for a pretty great example.

I love the parallels with investment banks, but I’m not sure how to apply them. Perhaps Lean Portfolios should seek to raise capital on the stock markets?

I agree that big tech companies tend to double down on their current products rather than figure out how to continue the innovation that made them successful. A successful product inevitably becomes bloated with features intended to expand sales into new customer segments, but which in fact serve to make it cumbersome for basic usage, and unintelligible to new users. This prepares the ground for a new crop of competitors with simplified solutions (but who will probably succumb to the same end).

In terms of the lessons you call out:

I agree fully that spin outs should be allowed to fail. I think the whole approach relies on a “fail fast” culture, and that this must extend all the way to spin outs.

Making multiple bets in a space is very interesting, if tricky. With one established spin out operating in a market, a second could potentially benefit from several advantages (e.g., great market knowledge, access to customers, business processes). I can easily imagine being tempting to specialize into a particular market with multiple startups, but the challenge would be to incentivize cooperation between their competing founders.

Many thanks for your great comment, and let’s catch up next time I’m in the bay area.

Sean

May 9, 2012 at 10:29 am, Brian Gladstein says:

Hi Sean, What an interesting, attractive idea. I haven’t executed this model yet, but what you describe here is exactly my long-term vision for the company I have been building for 2 years.

Explorics is starting with Execution and People in your “EPIC” model. Our focus so far is on go-to-market. We employ lean startup strategies and help other companies with their IDEAS, using other sources of CAPITAL that have already been secured. We coach these companies and provide resources to help them discover their target customers, learn (in a validated way) about reaching that market, and then iterate their product & go-to-market strategies together to build something repeatable.

We are now adding our own product development resources into the mix because our clients are asking for us to build product front-ends that help them iterate even faster. And as that part of the business scales, we will be pushing our own IDEAS through the funnel too.

Then, in time, comes the CAPITAL part of your model, when we can self-fund our IDEAS, using our own PEOPLE who know how to EXECUTE.

Honestly – I don’t know if we will build this model over time. It is the dream for my company, but it is a new model that hasn’t been widely proven yet.

But now I’m thinking that maybe what I’m doing, while fairly unique, isn’t completely isolated. If there are smart people out there thinking about the same thing… perhaps I really am on the right track!

Thank you for sharing!

May 10, 2012 at 9:24 am, Rory says:

Sean,

Great post. Sound like a great idea, love the portfolio concept and I think it could work particularly in light of the work the Samwer bros etc are doing. In theory the portfolio approach should allow you to minimise the waste of the learning when the inevitable failures occur and might just bring the lean startup process to another (more efficient) level. Best of luck with it!!!!!!!

May 17, 2012 at 2:10 pm, Peter Connor says:

That’s an interesting idea Sean.

May 20, 2012 at 12:10 pm, Sean Blanchfield says:

Thanks to Phil Riordan for pointing out two more examples of portfolios – Kevin Rose’s Milk and Churn Labs.